F&I Software

Our future-ready F&I software automates warranty administration services for all aftermarket products throughout their lifecycle.

F&I Industries Served

Trucks

Powersports

RVs

Boats

Heavy Duty

Supported Aftermarket Products

Vehicle Service Contracts (VSC)

Certified Pre-Owned

Limited Warranty

Guaranteed Asset Protection (GAP)

Tire & Wheel

Prepaid Maintenance

Lease Wear & Tear

Appearance Protection

Dent Protection

Etch / Theft Protection

Rust Protection

Windshield Protection

Key Replacement

Lot Programs

Roadside Assistance

Manufacturer’s Warranty

PCRS F&I Solutions

Scalable Platform Built to Maximize Potential

Open Sales Platform

Allows users to provide real-time rates and contracts to dealer menus via eRating and eContracting. Users are able to issue policies with electronic signatures and present products to consumers through their own point of sales channels and/or their partners. Having 140+ partners in our network gives dealers the ability to connect to the eMenu or DMS system of their choice.

Policy Administration

Our policy administration software supports billing, commissions, cancellations, and different statuses of the policy throughout its lifetime, allowing for seamless coverage rating, contracting, and contract remittance. Being fully integrated with your accounting system lets you create, manage, and modify your agents, dealers, coverages, and contracts. This also grants your agents direct access via our Agent Portal.

Claims Administration

Our warranty administration software allows the dealer to expedite the claim process through automation and view detailed reporting to experience a quicker ROI. The easy-to-use screens follow the conversation between servicer and adjuster to allow for faster processing and decision times. Integration with inspection companies and virtual payments partners gives users the ability to make credit card payments for claims within the system. Also provides automated claim adjudication with CHIP technology.

Risk Management

Enables users to track earnings, profits, and reinsurance requirements through reporting and flexible earnings curve configurations. Also allows you to estimate premium earnings across products with revenue recognition. This helps to gain a greater understanding of cost points to help design new products.

Performance Reporting

Provides a cross section of analytical reports designed to support management’s goals for risk reduction. These parameter driven reports cover key risk areas that impact profitability such as: Class, Dealers, Dealer Groups, Make, Model, Coverage Plans, Terms, Vehicle Features, etc. This gives users the ability to evaluate the entire portfolio or sharpen the focus down to an individual item.

Dealer Participation

Allows dealers to participate in your DOWC (dealer-owned warranty companies), Reinsurance, Retro, and Cash Advance programs simultaneously to optimize profitability through PCRS.

Notification Center

This module’s easy-to-use interface allows administrators to configure emails, text notifications, and letters to best fit the receiver’s preferences via customizable templates and triggers. These triggers can be configured based on dollar amount, days, or miles. If you wish to communicate with your receiver in a different language, you have the ability to input the wording of your choosing.

AcceleRater

Supports your digital retailing strategy by providing a secure interface to track, report, and monitor all rate request usage. This add-on can handle an unlimited volume of rate requests, manage who has access, and provides added security controls.

Customer, Lender, and Servicer Portals

These three portals offer a 360-degree view that transforms your claims management for a more efficient, customer-centric experience. Each portal provides 24/7 self-service, access to reporting and data, and fewer manual processes to streamline functions between customer, lender, and servicer. Save time and money with these Claims Module add-ons.

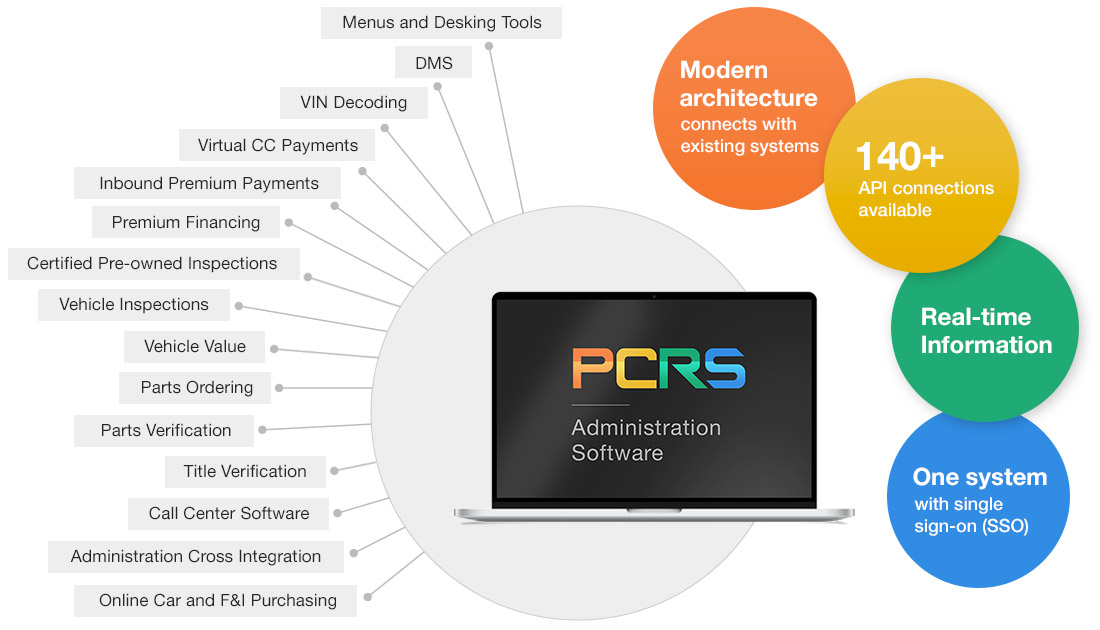

Connecting Through APIs

Connecting through APIs

Available Integrations

- Menus and Desking Tools

- DMS

- VIN Coding

- Virtual CC Payments

- Inbound Premium Payments

- Premium Financing

- Certified Pre-owned Inspections

- Vehicle Inspections

- Vehicle Value

- Parts Ordering

- Parts Verification

- Title Verification

- Call Center Software

- Administration Cross Integration

- Online Car and F&I Purchasing

PCMI provides endless opportunities to our clients through our strategic relationships with industry leaders. We have 140+ partners currently integrated to PCRS through our API connections allowing end-users a seamless experience by saving time and simplifying administration processes.

Benefits You Can’t Ignore

Automate

the full lifecycle of all aftermarket products and service contracts

Customize

your product offering using our flexible system

Integrate

with industry partners seamlessly using our API connections

Launch

new products to the market within days

Convert

your legacy data to administer and report all in one place

Secure

your data in our dedicated managed hosting environment

Reduce

personnel costs and eliminate the need for additional IT staff

Access

our user-friendly interface anytime, anywhere, on any browser