Transform

Streamline

Elevate

Maximize

Upgrade

Your Claims Operations

JM&A's outdated claims legacy system caused frustration with manual processes, disjointed systems, limited visibility, and slow traditional communication. These inefficiencies hindered productivity, impeded customer satisfaction, and posed a threat to JM&A's competitiveness in the market.

Transitioning to PCRS marked a pivotal point for JM&A as they gained a modern, cloud-based solution that allowed them to prioritize data. This secure electronic communication channel streamlined claims processing, enhanced transparency, and provided 24/7 self-service portals for customers and lenders.

Customers and lenders now initiate 96% of claims, showcasing JM&A's successful modernization. Customers praised JM&A's convenience, seamless processes, immediate feedback, and personalized communication, enhancing satisfaction and loyalty. Strengthened lender partnerships drove growth. This saved significant time, resources, and costs, solidifying JM&A's competitive edge and dedication to customer-centric solutions.

Customer Portal

Empower Your Customers, Elevate Your Brand

Discover the power of our vehicle management portal. This intuitive tool redefines how policy holders engage with their F&I products, creating a seamless experience and strengthening brand loyalty like never before.

Enhances brand loyalty

Streamlines multi-vehicle management

Removes dependency on customer service representatives

Gain insights of product consumption per household

Lender Portal for GAP

Digitalize and Accelerate Your Claims Process

Bid farewell to conventional phone, email, and fax communication. Give your lenders 24/7 access to initiate claims, accelerating your claims processes and enhancing data accuracy.

Eliminates the need for phone, email, and fax communication

Gives lenders 24/7 access to upload documents, enter financial info, and view claims status

Removes dependency on customer service representatives

Works seamlessly with our Customer Portal

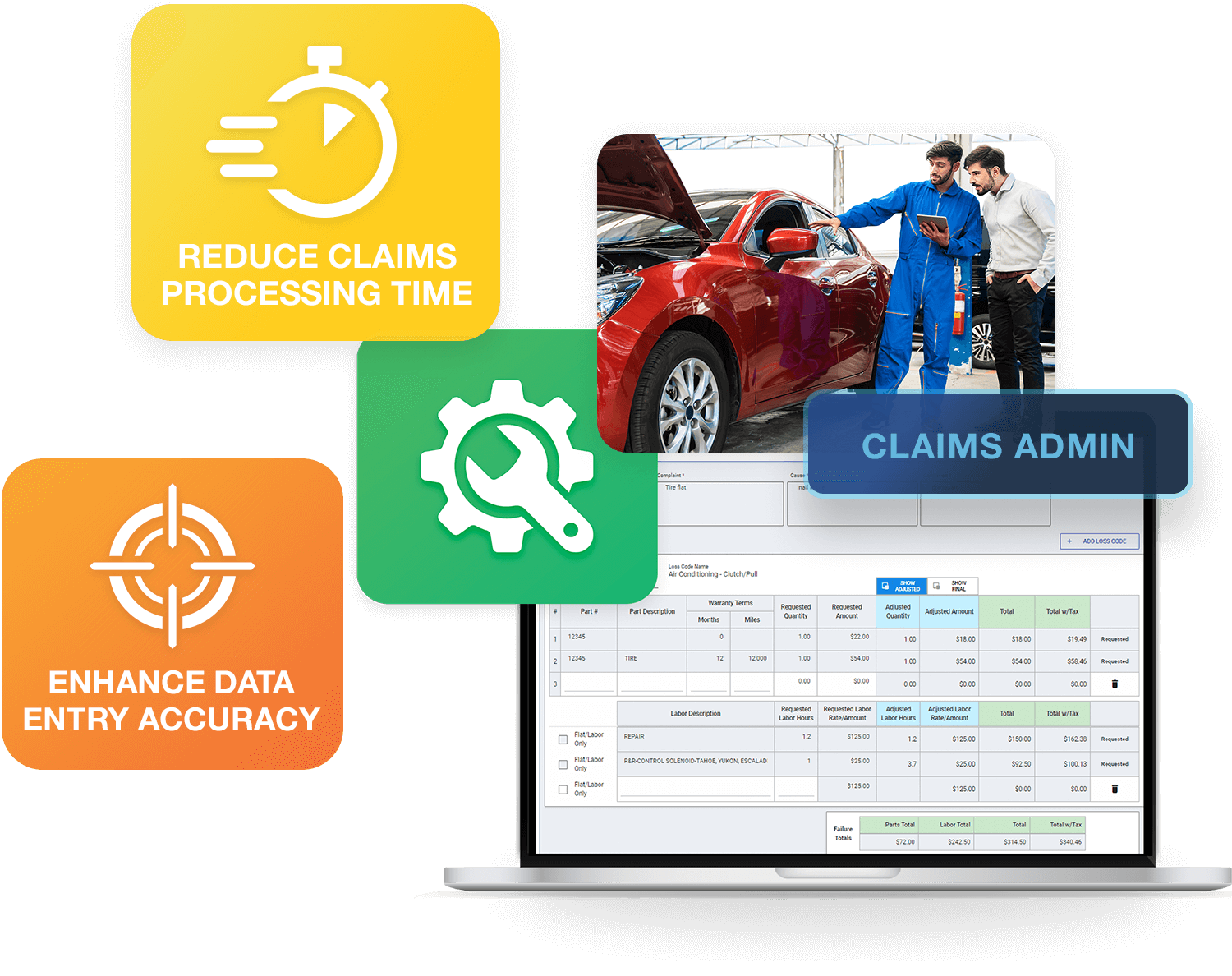

Servicer Portal

Optimize Repairs, Enhance Satisfaction

Step into the future of repair management. This portal offers real-time access for claims processing at dealerships and service centers. Eliminate manual bottlenecks, amplify repair facility efficiency, and deliver unparalleled customer satisfaction.

Saves time and enhances data accuracy

Allows adjusters to dedicate more time to claim assessments

Enables service advisors to effortlessly enter claims

Facilitates real-time claim submissions by advisors, allowing for quicker resolution

Claims Integrations

Get repair orders paid quickly, make and track claims payments, and lower costs with a virtual credit card

Speed up agent commission payments by allowing your dealers to schedule payments via ACH or credit card

Reduce fraud with verified, AI informed images directly from service centers when a physical or virtual inspection is deployed

Research pricing, create and document quotes, and order top-tier quality parts all in one screen to streamline your claims process

End-to-end solution empowering TPAs and Agents

Discover how PCRS can simplify every stage of your product lifecycle, including sales, rating, policy administration, claims processing, and profit analysis.